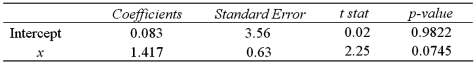

The accompanying table shows the regression results when estimating  .Is x significantly related to y at the 5% significance level?

.Is x significantly related to y at the 5% significance level?

Definitions:

Applicants

Individuals who apply or express interest in a job, program, or opportunity, seeking to become candidates for selection.

HRISs

Human Resource Information Systems, digital solutions for managing an organization's people-related data and processes.

Technological Effect

The impact of technology on society, including changes in behaviour, efficiency, and economic structures.

Relational

Pertaining to or characterized by relationships or connections between people.

Q1: Exhibit 15-7.A manager at a local bank

Q9: Exhibit 17.3.Consider the regression model, Humidity =

Q28: Which of the following statements is true

Q44: Exhibit 16-4.The following data shows the cooling

Q55: For a sample of 10 observations drawn

Q58: Exhibit 20.9.A shipping company believes there is

Q66: Exhibit 16.5.The following data shows the demand

Q67: Exhibit 17.8.A realtor wants to predict and

Q68: Exhibit 17.1.A researcher has developed the following

Q78: When a time series is analyzed by