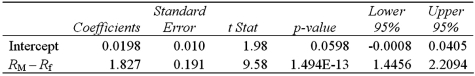

Exhibit 15-6.Tiffany & Co.has been the world's premier jeweler since 1837.The performance of Tiffany's stock is likely to be strongly influenced by the economy.Monthly data for Tiffany's risk-adjusted return and the risk-adjusted market return are collected for a five-year period (n = 60) .The accompanying table shows the regression results when estimating the CAPM model for Tiffany's return.  Refer to Exhibit 15-6.To determine whether abnormal returns exist,which of the following competing hypotheses do you set up?

Refer to Exhibit 15-6.To determine whether abnormal returns exist,which of the following competing hypotheses do you set up?

Definitions:

Units

Basic measures or quantities adopted to quantify and express the count of objects, substance volume, or other phenomena.

Cold Drinks

Beverages that are served chilled, often including sodas, iced teas, and various types of juices.

Temperature

A physical quantity expressing the subjective perceptions of hot and cold, measured by a thermometer.

Increased

A term denoting a situation or quantity that has grown or become larger or greater in size, volume, number, or degree.

Q18: A travel agent wants to determine if

Q20: Exhibit 16.2.Typically,the sales volume declines with an

Q28: When applying the goodness-of-fit test for normality,the

Q29: Exhibit 14-9.When estimating <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2339/.jpg" alt="Exhibit 14-9.When

Q33: Exhibit 17.9.A bank manager is interested in

Q39: Exhibit 19-2.Hugh Wallace has the following information

Q51: Exhibit 15-9.An economist estimates the following model:

Q53: Non-causal forecasting models are purely time series

Q63: Pfizer Inc.is the world's largest research-based pharmaceutical

Q91: Suppose you want to determine if mutual