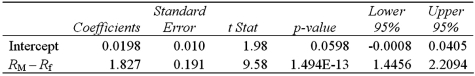

Exhibit 15-6.Tiffany & Co.has been the world's premier jeweler since 1837.The performance of Tiffany's stock is likely to be strongly influenced by the economy.Monthly data for Tiffany's risk-adjusted return and the risk-adjusted market return are collected for a five-year period (n = 60) .The accompanying table shows the regression results when estimating the CAPM model for Tiffany's return.  Refer to Exhibit 15-6.To determine whether abnormal returns exist,which of the following competing hypotheses do you set up?

Refer to Exhibit 15-6.To determine whether abnormal returns exist,which of the following competing hypotheses do you set up?

Definitions:

SUMIFS

A function in spreadsheet software that sums the values in a range based on multiple criteria.

SUMIFS

A function in Excel that adds the cells specified by a given set of conditions or criteria.

Precedents

In computing, refers to cells in a spreadsheet that affect the formula in another cell; in law, it refers to previous court decisions that guide future cases.

Create From Selection

A feature in various software applications that allows users to generate new content or objects based on a selected item or area.

Q7: Exhibit 19-5.Firms A,B,and C operate in the

Q10: Exhibit 13.8 A market researcher is studying

Q32: Jack Simmons is expecting to earn a

Q33: Given the following portion of regression results,which

Q37: In the sample regression equation <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2339/.jpg"

Q52: Exhibit 16.2.Typically,the sales volume declines with an

Q53: Exhibit 16.5.The following data shows the demand

Q58: Exhibit 18.7.The following table shows the annual

Q60: The cyclical component of a time series

Q68: Which of the following is true of