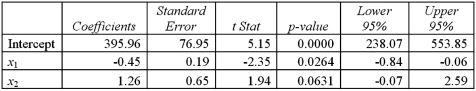

When estimating a multiple regression model based on 30 observations,the following results were obtained.  a.Specify the hypotheses to determine whether x1 is linearly related to y.At the 5 % significance level,use the p-value approach to complete the test.Are x1 and y linearly related?

a.Specify the hypotheses to determine whether x1 is linearly related to y.At the 5 % significance level,use the p-value approach to complete the test.Are x1 and y linearly related?

B)Construct the 95% confidence interval for β2.Using this confidence interval,is x2 significant in explaining y? Explain.

C)At the 5% significance level,can you conclude that β1differs from -1? Show the relevant steps of the appropriate hypothesis test.

Definitions:

Private-Sector Employees

Refers to individuals who are employed by businesses or organizations that are not owned or operated by the government.

Robinson-Patman Act

A 1936 United States law aimed at preventing unfair competition and price discrimination by requiring sellers to offer the same price terms to all buyers.

Price Discrimination

A pricing strategy where identical or substantially similar goods or services are sold at different prices by the same provider in different markets or to different buyers.

Regulated Monopolies

Companies that are the sole provider of a product or service in a market, but their operations are regulated by government entities to ensure fair practices.

Q5: An economist examines the relationship between the

Q11: Which of the following is not true

Q11: Exhibit 16.5.The following data shows the demand

Q33: Consider the sample regression equation: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2339/.jpg"

Q39: The correlation coefficient can only range between

Q44: The following table provides the values of

Q78: Exhibit 19-1.Joanna Robertson bought a share of

Q88: If a test statistic has a value

Q90: Exhibit 10.6.A university wants to compare out-of-state

Q102: The _ is a trend model that