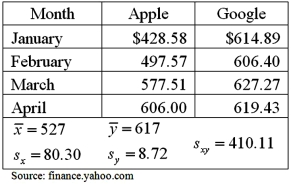

A portfolio manager is interested in reducing the risk of a particular portfolio by including assets that have little,if any,correlation.He wonders whether the stock prices for the firms Apple and Google are correlated.As a very preliminary step,he collects the monthly closing stock price for each firm from January 2012 to April 2012.  a.Compute the sample correlation coefficient.

a.Compute the sample correlation coefficient.

B)Specify the competing hypotheses in order to determine whether the stock prices are correlated.

C)Calculate the value of the test statistic and approximate the corresponding p-value.

D)At the 5% significance level,what is the conclusion to the test? Explain.

Definitions:

Gender Interactions

The ways in which individuals behave towards, communicate with, and perceive people of the same or different gender identities.

Critical Distance

Critical distance refers to the ability to analyze and evaluate a culture, society, or situation objectively, without allowing personal biases or assumptions to influence judgment.

Sociologists

Scientists who study the development, structure, and functioning of human society, including social relationships, institutions, and behaviors.

Macrosociological Theorists

Sociologists who focus on the study of large-scale social structures and processes, as opposed to individuals or small groups.

Q3: A fast-food franchise is considering building a

Q10: Using the same data set,four models are

Q11: For the logistic model,the predicted values of

Q20: Exhibit 17.8.A realtor wants to predict and

Q28: Exhibit 11-4.Consider the expected returns (in percent)from

Q28: Exhibit 16.2.Typically,the sales volume declines with an

Q39: Exhibit 18.6.Based on quarterly data collected over

Q45: Exhibit 16-4.The following data shows the cooling

Q59: If the chosen significance level is <img

Q116: Exhibit 14-1.Over the past 30 years,the sample