An investment analyst wants to examine the relationship between a mutual fund's return,its turnover rate and its expense ratio.She randomly selects 10 mutual funds and estimates: Return =  +

+  Turnover +

Turnover +  Expense +

Expense +  ,where Return is the average five-year return (in %),Turnover is the annual holdings turnover (in %),Expense is the annual expense ratio (in %),and

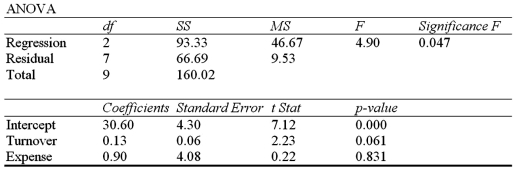

,where Return is the average five-year return (in %),Turnover is the annual holdings turnover (in %),Expense is the annual expense ratio (in %),and  is the random error component.A portion of the regression results is shown in the accompanying table.

is the random error component.A portion of the regression results is shown in the accompanying table.  a.Predict the return for a mutual fund that has an annual holdings turnover of 60% and an annual expense ratio of 1.5%.

a.Predict the return for a mutual fund that has an annual holdings turnover of 60% and an annual expense ratio of 1.5%.

B)Interpret the slope coefficient attached to Expense.

C)Calculate the standard error of the estimate.If the sample mean for Return is 34.7%,what can you infer about the model's predictive power.

D)Calculate and interpret the coefficient of determination.

Definitions:

Regulatory Purposes

The intention or rationale behind establishing guidelines, laws, or standards designed to control or govern conduct within various sectors.

Voluntary Turnover

The act of an employee leaving an organization based on their own decision, often for reasons such as better job opportunities, dissatisfaction, or personal circumstances.

Conflicting Opinions

Refers to situations where individuals or groups have differing beliefs, perspectives, or opinions on a particular subject.

Q1: The values of the <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2339/.jpg" alt="The

Q4: Exhibit 17.5.An over-the-counter drug manufacturer wants to

Q15: Construct a 95% confidence interval for the

Q21: In the simple linear regression model,β<sub>0</sub> is

Q23: What is the effect of b<sub>2</sub> <

Q49: Exhibit 16.5.The following data shows the demand

Q58: In testing the population correlation coefficient,the alternative

Q74: Exhibit 10.2.Calcium is an essential nutrient for

Q84: How many coefficients have to be estimated

Q92: The _ is the probability distribution of