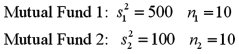

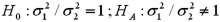

Exhibit 11-6.A financial analyst examines the performance of two mutual funds and claims that the variances of the annual returns for the bond funds differ.To support his claim,he collects data on the annual returns (in percent) for the years 2001 through 2010.The analyst assumes that the annual returns for the two emerging market bond funds are normally distributed.Here are some relevant summary statistics.  Refer to Exhibit 11-6.Repeat the hypothesis test,

Refer to Exhibit 11-6.Repeat the hypothesis test,  since

since  .What is the critical F value at the 10% significance level?

.What is the critical F value at the 10% significance level?

Definitions:

Garnishment of Wages

A legal process where a portion of an individual's earnings is withheld by an employer for the payment of a debt.

Consumer Protection Legislation

Laws and regulations designed to ensure fair trade competition and the free flow of truthful information in the marketplace, protecting consumers from fraudulent or unfair practices.

Credit Charges

Fees or interest rates applied to the balance of borrowed funds or extended credit.

Consumer Protection

Measures and regulations designed to safeguard buyers of goods and services against fraudulent or unfair practices.

Q10: Exhibit 12.4 In the following table,likely voters'

Q21: Exhibit 13.7 A market researcher is studying

Q51: If units within each block are randomly

Q65: A sample of 200 monthly observations is

Q66: A coach is examining two basketball players'

Q87: Exhibit 9-1.A university is interested in promoting

Q92: The Office of Career Services at a

Q93: Exhibit 12.2 A university has six colleges

Q96: Exhibit 10.10.A bank is trying to determine

Q103: A recent report claimed that Americans are