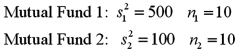

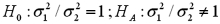

Exhibit 11-6.A financial analyst examines the performance of two mutual funds and claims that the variances of the annual returns for the bond funds differ.To support his claim,he collects data on the annual returns (in percent) for the years 2001 through 2010.The analyst assumes that the annual returns for the two emerging market bond funds are normally distributed.Here are some relevant summary statistics.  Refer to Exhibit 11-6.For the competing hypotheses:

Refer to Exhibit 11-6.For the competing hypotheses:  since

since  ,approximate the p-value for the test.

,approximate the p-value for the test.

Definitions:

Relevant Range

The range of activity within which the assumptions about fixed costs and variable unit costs are valid for purposes of budgeting and decision-making.

Direct Costs

Expenses that can be directly traced to the production of specific goods or services, such as raw materials and labor.

Period Costs

Expenses that are not directly associated with the production process and are expensed in the period they are incurred.

Financial Reporting

The process of producing statements that disclose an organization's financial status to management, investors, and regulators.

Q10: Exhibit 9-3.The Boston public school district has

Q15: In any production process,variations in the quality

Q18: According to a 2009 Lawyers.com survey,only 35%

Q30: What are the degrees of freedom for

Q34: The following scatterplot implies that the relationship

Q43: Exhibit 13.4 The ANOVA test performed for

Q48: Professor Elderman has given the same multiple

Q67: The skewness of the Chi-square probability distribution

Q79: A random sample of 10 homes sold

Q84: Exhibit 13.6 A researcher wants to understand