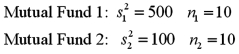

Exhibit 11-6.A financial analyst examines the performance of two mutual funds and claims that the variances of the annual returns for the bond funds differ.To support his claim,he collects data on the annual returns (in percent) for the years 2001 through 2010.The analyst assumes that the annual returns for the two emerging market bond funds are normally distributed.Here are some relevant summary statistics.  Refer to Exhibit 11-6.At α = 0.10,is the analyst's claim supported by the data using the critical value approach?

Refer to Exhibit 11-6.At α = 0.10,is the analyst's claim supported by the data using the critical value approach?

Definitions:

Brain Scanning

The use of various medical imaging technologies to study the structure and function of the brain for research and clinical diagnosis.

Buying Processes

The series of steps consumers or organizations follow to make a purchase decision, including need recognition, information search, evaluation, and the purchase decision.

Martin Lindstrom

A recognized authority in branding and consumer behavior, known for his writings and insights on how companies can create impactful brands.

Buyology

The study of consumer purchasing behavior and the psychological influences behind decision-making.

Q3: The null hypothesis <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2339/.jpg" alt="The null

Q9: Consider the following sample data: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2339/.jpg"

Q22: Serial correlation occurs when the error term

Q30: What are the degrees of freedom for

Q31: Exhibit 8-2.The mortgage foreclosure crisis that preceded

Q31: Exhibit 12.6 The following table shows the

Q34: Exhibit 13.2 A researcher with Ministry of

Q41: For the chi-square test of a contingency

Q66: Pfizer Inc.is the world's largest research-based pharmaceutical

Q80: Exhibit 10.13.A consumer magazine wants to figure