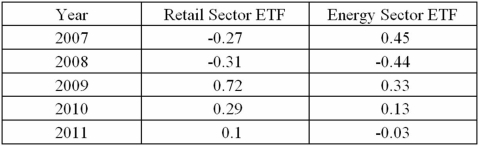

The following is return data for a Retail sector ETF and Energy Sector ETF for the years 2007 through 2011.  a.What is the arithmetic mean return for each ETF?

a.What is the arithmetic mean return for each ETF?

B)What is the geometric mean return for each ETF?

C)What is the sample standard deviation for each ETF? Which ETF was riskier over this time period?

D)Given a risk free rate of 5%.What is the Sharpe Ratio for each ETF? Which investment had a better return per unit of risk over this time period?

Definitions:

Variable Costs

Expenses that change in proportion to the activity of a business, such as materials and labor.

Marginal Cost

The incremental cost involved in creating an extra unit of a product or service.

Diseconomies of Scale

Occur when a firm's costs per unit increase as its output increases, opposite to economies of scale.

Production Costs

The total expense incurred in manufacturing a product or providing a service, including labor, materials, and overhead expenses.

Q9: Using minutes as the unit of measurement

Q11: George Dantzig is important in the history

Q36: A probability based on logical analysis rather

Q41: Converting a transportation problem LP from cost

Q49: A feasible solution is one that satisfies

Q59: The likelihood of rain has been reported

Q85: Exhibit 6-5.The mean travel time to work

Q108: Which of the following does not represent

Q115: The terms central location or central tendency

Q123: In a data set,an outlier is a