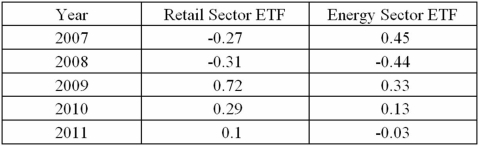

The following is return data for a Retail sector ETF and Energy Sector ETF for the years 2007 through 2011.  a.What is the arithmetic mean return for each ETF?

a.What is the arithmetic mean return for each ETF?

B)What is the geometric mean return for each ETF?

C)What is the sample standard deviation for each ETF? Which ETF was riskier over this time period?

D)Given a risk free rate of 5%.What is the Sharpe Ratio for each ETF? Which investment had a better return per unit of risk over this time period?

Definitions:

ADRs

American Depositary Receipts, a way for investors to own shares in foreign companies, where the shares are held by a US financial institution overseas and traded on American exchanges.

WEBS

Exchange-traded funds that track international stock market indices, allowing investors to diversify their portfolios globally.

Derivative Securities

Financial instruments whose value is derived from the value of other, underlying assets.

Nikkei Stock Index

A stock market index for the Tokyo Stock Exchange, representing the performance of 225 top-rated companies listed in Japan.

Q6: The output shows the solution to a

Q7: A car salesman has a 5% chance

Q14: The following table shows average wind speeds

Q14: What is the scale of measurement of

Q19: A transshipment problem is a generalization of

Q30: Classical sensitivity analysis provides no information about

Q31: The probability density function of a continuous

Q37: If the optimal value of a decision

Q53: A manufacturing process produces tubeless mountain bike

Q75: Exhibit 2-10.Automobiles traveling on a road with