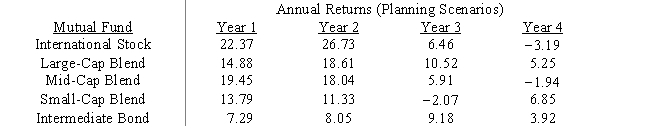

Portfolio manager Max Gaines needs to develop an investment portfolio for his clients who are willing to accept a moderate amount of risk.His task is to determine the proportion of the portfolio to invest in each of the five mutual funds listed below so that the portfolio provides an annual return of no less than 3%.Formulate the appropriate linear program.

Definitions:

Exercise Price

The specified price on an option contract at which the option holder can buy (in the case of a call option) or sell (in the case of a put option) the underlying asset.

2-for-1 Split

A stock split in which a company divides its existing shares into two, reducing the price per share while keeping the total market capitalization the same.

Underlying Stock

The stock that is the basis or the security that options, futures, or other derivatives contracts are derived from or based upon.

Options

Financial derivatives that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a specified date.

Q17: All uncontrollable inputs or data must be

Q17: A path through a project network must

Q26: A simulation model provides a convenient experimental

Q26: From this PERT/CPM network,create a list of

Q38: A study of teen smoking is planned.Researchers

Q47: The EOQ model is insensitive to small

Q58: We represent the number of units shipped

Q85: When displaying quantitative data,what is an ogive

Q96: The accompanying cumulative relative frequency distribution shows

Q96: The covariance between the returns on two