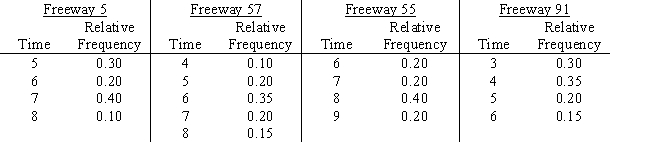

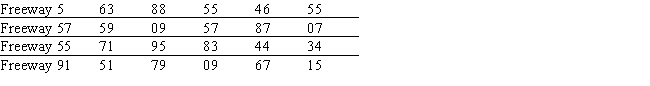

Susan Winslow has two alternative routes to travel from her home in Olport to her office in Lewisburg.She can travel on Freeway 5 to Freeway 57 or on Freeway 55 to Freeway 91.The time distributions are as follows:

Do a five-day simulation of each of the two combinations of routes using the random numbers below.Based on this simulation,which routes should Susan take if her objective is to minimize her total travel time?

Definitions:

Extreme Negative Returns

Significant losses in investment value over a short period, often unexpected.

Value At Risk

Value at Risk (VaR) is a statistical measure used to assess the risk of loss on a specific portfolio of financial assets, indicating the maximum potential loss over a given time frame at a certain confidence level.

Negatively Skewed

Refers to a distribution that is asymmetrical and has a longer tail on the left side of the peak, indicating more values fall below the mean.

Standard Deviation

A statistical measure representing the dispersion or variability of a set of data points from their mean, often used in finance to gauge the volatility of an investment.

Q13: If a Markov chain has at least

Q14: One limitation of a scoring model is

Q15: Computing the consistency ratio for a criterion's

Q16: A one-sided range of optimality<br>A)always occurs for

Q22: G&P Manufacturing would like to minimize the

Q26: The constraint 5x<sub>1</sub> + 3x<sub>2</sub> ≤ 150

Q27: When blocked customers are cleared,an important decision

Q30: Upon completion of a DEA model,all operating

Q37: The owner of a small construction firm

Q38: Audio Disks will be opening outlets in