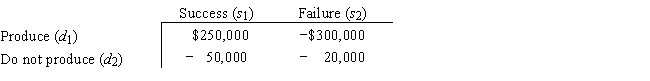

Super Cola is also considering the introduction of a root beer drink.The company thinks the probability that the product will be a success is 0.6.The payoff table is as follows:

The company has a choice of two research firms to obtain information for this product.Stanton Marketing has market indicators I1 and I2 for which P(I1 | s1)= 0.7 and P(I1 | s2)= 0.4.New World Marketing has indicators J1 and J2 for which P(J1 | s1)= 0.6 and P(J1 | s2)= 0.3.

a.

What is the optimal decision if neither firm is used? Over what probability of success range is this decision optimal?

b.What is the EVPI?

c.Find the EVSIs and efficiencies for Stanton and New World.

d.If both firms charge $5,000,which firm should be hired?

e.

If Stanton charges $10,000 and New World charges $4000,which firm should Super Cola hire?

Definitions:

Pension Asset

Refers to the resources set aside by a company in a pension fund to meet future pension liabilities to its employees.

Projected Benefit Obligation

A measurement of the present value of future pension benefits earned to date as estimated by actuaries, used in accounting for pension plans.

Balance Sheet

A report detailing a company's assets, obligations, and the equity of its shareholders at a particular moment.

Projected Benefit Obligation

An actuarial estimate of the total present value of future retirement benefits earned to date, adjusted for expected future salary increases.

Q2: The main difference between CPM and PERT

Q3: The primal problem is as follows: <img

Q14: A linear programming application used to measure

Q15: If an absorbing state exists,then the probability

Q23: Revenue management methodology enables an airline to

Q34: Let x1 and x2 be 0-1 variables

Q45: The minimum value for a convex function

Q45: Little's flow equations can apply to a

Q49: Westfall Company has a contract to produce

Q50: Most practical applications of integer linear programming