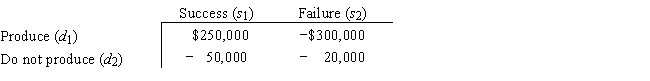

Super Cola is also considering the introduction of a root beer drink.The company thinks the probability that the product will be a success is 0.6.The payoff table is as follows:

The company has a choice of two research firms to obtain information for this product.Stanton Marketing has market indicators I1 and I2 for which P(I1 | s1)= 0.7 and P(I1 | s2)= 0.4.New World Marketing has indicators J1 and J2 for which P(J1 | s1)= 0.6 and P(J1 | s2)= 0.3.

a.

What is the optimal decision if neither firm is used? Over what probability of success range is this decision optimal?

b.What is the EVPI?

c.Find the EVSIs and efficiencies for Stanton and New World.

d.If both firms charge $5,000,which firm should be hired?

e.

If Stanton charges $10,000 and New World charges $4000,which firm should Super Cola hire?

Definitions:

Physical Store

A brick-and-mortar location where businesses sell their products or services directly to customers in person.

Near Field Communications

A set of communication protocols that enable two electronic devices, one of which is usually a portable device such as a smartphone, to establish communication by bringing them within a short distance of each other.

Showrooming

The practice of visiting a store or showroom to examine a product before buying it online at a lower price.

Third Party Sellers

Independent vendors who sell their products or services through a third party platform or marketplace.

Q6: The operations research analyst for a big

Q7: Shortening activity times,which is usually accomplished by

Q13: Revenue management methodology enables an airline to<br>A)maximize

Q16: Write the following problem in tableau form.Which

Q30: Show both the network and the linear

Q33: Find the vector with initial point

Q34: The transportation simplex method is limited to

Q34: If a problem has multiple goals at

Q39: Activities G,P,and R are the immediate predecessors

Q55: The economic production lot size model is