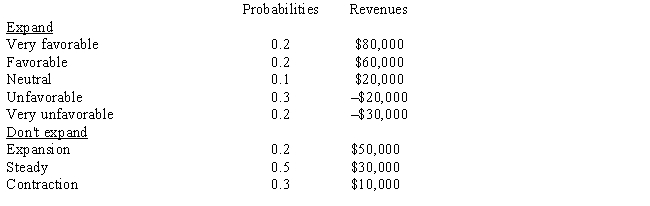

A Pacific Northwest lumber company is considering the expansion of one of its mills.The question is whether to do it now or wait one year and reconsider.If it expands now,the major factors are the state of the economy and the level of interest rates.The combination of these two factors results in five possible situations.If it does not expand now,only the state of the economy is important and three conditions characterize the possibilities.The following table summarizes the situation:

a.Draw the decision tree for this problem.

b.What is the expected value for expanding?

c.What is the expected value for not expanding?

d.Based on expected value,what should the company's decision(s)be?

Definitions:

Discount Rates

Discount rates refer to the interest rate charged to commercial banks and other financial institutions for loans received from the central bank's discount window.

Federal Funds Rate

The interest rate banks and other depository institutions charge one another on overnight loans made out of their excess reserves.

Borrowed Reserves

Funds that commercial banks borrow from the central bank to meet reserve requirements, often indicative of a tight monetary policy.

Fed

The Federal Reserve System, which is the central bank of the United States responsible for monetary policy.

Q1: The Super Discount store (open 24 hours

Q10: Three airlines compete on the route between

Q13: A feasible solution is a global optimum

Q24: Use graphical sensitivity analysis to determine the

Q25: Each simulation run provides only a sample

Q30: Which of the following is NOT implied

Q31: To handle unacceptable routes in a transportation

Q47: A project network is shown below.Use a

Q53: Super Cola is considering the introduction of

Q75: Sketch a graph of the rectangular