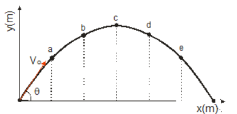

Use the figure to answer the question.

The figure represents the parabolic trajectory of a ball going from a to e in Earth gravity but without air resistance. The initial velocity of the ball is Vo at an angle  to the horizon. The vertical dashed lines represent equal time interval,

to the horizon. The vertical dashed lines represent equal time interval,

-The horizontal velocity at point c is

Definitions:

Income Tax

A tax levied by governments on individuals or entities' income, constituting a major source of government funding.

Present and Future Consumption

The concept of analyzing and balancing what is consumed today against what will be available or necessary for consumption in the future.

Efficient Taxation

A taxation system designed to minimize the economic costs or distortions that it imposes on society, while achieving desired revenue and distributional effects.

Excess Burden

The cost to society created by market inefficiency, typically due to taxes or government policies that distort resource allocation.

Q27: In the figure, m<sub>1</sub> = 3 kg,

Q35: The figure represents the parabolic trajectory of

Q37: The reference point for gravitational potential energy<br>A)

Q38: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6080/.jpg" alt=" A block of

Q39: If the position of an object is

Q53: A proton has a rest mass

Q60: Two objects, one of mass m<sub>1</sub> =

Q77: A force F produces an acceleration a

Q97: You are traveling in your car at

Q177: Solve the equation <span class="ql-formula"