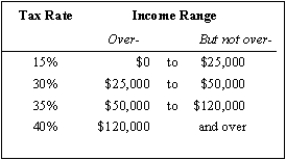

Exhibit 14-1

-Refer to Exhibit 14-1. If an individual is earning $38,500 in taxable income, that individual will be able to keep how much of one more dollar earned?

Definitions:

Capital Budgeting

The process by which investors or management assess potential large expenditures or investments to determine their profitability.

Internal Rate of Return (IRR)

The discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero.

Initial Investment

The initial amount of money required to start a project, investment, or business, often used to assess its feasibility and potential return.

Negative Cash Flow

A situation where a business or individual's outflows of cash exceed their incoming cash, indicating potential financial trouble.

Q16: When transactions costs are high or free-rider

Q16: What is the difference between financial capital

Q19: Most economists agree that resale price maintenance

Q33: A firm seeks to differentiate its products

Q55: Physical capital is a good used to

Q64: The antitrust case standard that holds that

Q105: The Laffer curve indicates that very high

Q147: Government can internalize externalities by<br>A)taxing goods with

Q162: Compensating wage differentials are the differences in

Q170: Refer to the figure below.To correct the