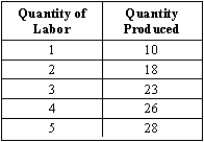

Exhibit 6-1

-When total product is rising, marginal product

Definitions:

Gross Investment Income

The total income generated from various investment sources before any deductions or taxes are applied.

Medical Expense Deduction

A tax deduction allowed for unreimbursed medical expenses that exceed a certain percentage of the taxpayer's adjusted gross income.

Dependent

Dependent is a person, typically a child or elderly family member, whose support and maintenance are provided by another, qualifying the supporting individual for certain tax benefits.

Pease Limitations

Named after Congressman Don Pease, these are limits on the amount of itemized deductions that high-income individuals can claim.

Q45: A variable factor is the type of

Q82: When a surplus exists in a market,the

Q101: Refer to Exhibit 7-12.Calculate the total tax

Q105: Fixed cost does not vary with the

Q116: In the competitive equilibrium model,<br>A)utility and marginal

Q120: If the price of a good decreases

Q155: Fixed costs exist in<br>A)both the long run

Q161: In Exhibit 3-4,if D<sub>1</sub> and S<sub>1</sub> are

Q163: Other things being equal,an increase in marginal

Q165: Because marginal cost increases as output increases,<br>A)marginal