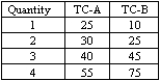

Firm A and Firm B both produce the same product with the following total costs (TC):  Consider the situation in which the market price is $15 and each of the two firms produces 2 units.

Consider the situation in which the market price is $15 and each of the two firms produces 2 units.

(A)Is the situation Pareto efficient? Explain.

(B)Suggest one different production allocation for the two firms that allows the 4 units of total output to be produced at a lower overall total cost.

(C)Would the outcome of your suggested production allocation maximize firm profits?

Definitions:

Semi-Annually

Occurring twice a year; a term often used in the context of paying interest or dividends.

Yield To Maturity

The total return anticipated on a bond if it is held until its maturity date, considering all interest payments and the principal repayment.

Par

The face value of a bond or other security, at which it can be redeemed at maturity or the amount of money equal in value to a particular share or bond.

Coupon

The yearly payment of interest to those holding bonds, represented as a percentage of the bond's nominal value.

Q22: Exhibit 2A-1 is an example of a<br>A)bar

Q37: Deadweight loss occurs in a price floor

Q40: Why can't economists identify a definite time

Q52: Without market coordination,<br>A)prices are entirely ignored.<br>B)only that

Q70: Refer to Exhibit 6-6.Let market price be

Q83: How is information conveyed from one individual

Q85: Refer to Exhibit 8-2.The fixed cost is<br>A)$20.<br>B)$100.<br>C)$120.<br>D)$185.<br>E)$326.

Q85: Pareto efficiency cannot be achieved when<br>A)price equals

Q129: On a supply and demand diagram,consumer surplus

Q129: Refer to Exhibit 7-1.If it is somehow