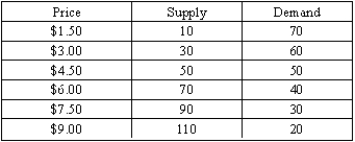

Consider the following supply and demand schedule:

(A)Draw the market supply and demand curves.Show the equilibrium quantity,price,producer surplus,and consumer surplus.

(B)Describe what would happen to the price of this product if a tax of $4.50 per unit sold is enacted by the government.Show your answer graphically.

(C)Show the deadweight loss due to the tax on your diagram.

Definitions:

Protective Put

An options strategy where an investor holds a position in a stock and purchases a put option on the same stock to protect against a decline in its price.

Gross Profit

The difference between sales revenue and the cost of goods sold, before deducting overheads, payroll, taxation, and interest payments.

Net Profit

The financial gain produced after subtracting all expenses, taxes, and costs from total revenue.

Exercise Option

An option in derivatives trading that allows the holder to buy or sell an asset at a predetermined price before or on a specific date.

Q12: Exhibit 7-9 shows the effect of a

Q29: Average fixed cost always declines as output

Q51: If real interest rates in the rest

Q77: Economies of scale and economies of scope

Q96: An industry is<br>A)a group of firms that

Q110: When an industry is in decline,firms do

Q115: Refer to Exhibit 5-2.Which of the following

Q126: In economics,income inequality means Pareto inefficiency.

Q127: In the United States,inflation is the responsibility

Q168: Marginal cost begins to increase when<br>A)total cost