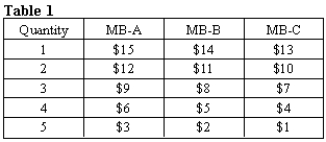

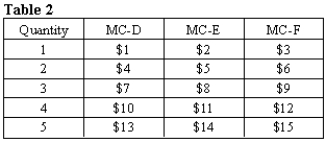

Suppose there are three buyers (A,B,and C)and three sellers (D,E,and F)in a competitive market with the marginal benefit (MB)schedules shown in Table 1 and the marginal cost (MC)schedules shown in Table 2.

Verify that the three efficiency conditions are satisfied for the market when the equilibrium price is $8.

Verify that the three efficiency conditions are satisfied for the market when the equilibrium price is $8.

Definitions:

Risk-free Asset

An investment that is expected to return its full original value along with a specified interest rate with virtually no risk of financial loss.

Beta

An evaluation of the unsteadiness, or systematic jeopardy, of a security or collective financial investments when compared to the market as a whole.

CAPM

The Capital Asset Pricing Model, a formula used to determine the theoretical expected return of an investment given its risk relative to the market.

Risk-free Asset

An investment with zero risk of financial loss, typically considered to be government bonds.

Q6: Refer to Exhibit 2A-4.The slope of the

Q31: A relationship showing that exam grades are

Q38: Can income equality and efficiency be achieved

Q64: As tastes and preferences differ from person

Q69: When fertilizer yields diminishing returns in the

Q86: Use the cost function information provided in

Q93: A rise in world real interest rates

Q109: In economics,firms are assumed to<br>A)maximize output prices.<br>B)minimize

Q124: Supply may be elastic,unit elastic,or inelastic.

Q134: Economists assume that marginal utility cannot be