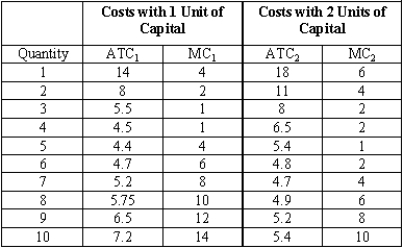

Given the following data for a typical firm in a competitive industry,sketch the two short-run average total cost curves and the two marginal cost curves,and answer the following:  (A)What is the long-run price and quantity produced for the typical firm in this industry? How many units of capital will the firm be using?

(A)What is the long-run price and quantity produced for the typical firm in this industry? How many units of capital will the firm be using?

(B)Suppose the current market price of the output is $6.What level of capital and output is profit-maximizing? Explain.

(C)

Suppose the price of the output increases to $10.What level of capital and output is profit-maximizing now?

(D)Will it make sense for the firm to expand even when the long-run equilibrium may be at a lower level of capital? On what does it depend?

Definitions:

Notes Payable

Financial obligations represented by promissory notes, which require the payer to repay the debt within a specified timeframe.

Asset Utilization Ratio

A metric that measures how efficiently a firm uses its assets to generate sales or revenue.

Net Income

The remainder income for a company once it has accounted for all expenditures and tax payments from its earnings.

Sales

Transactions involving the exchange of goods or services for money or equivalent rewards.

Q24: The third substantial piece of fiscal policy

Q47: In a competitive market,capital allocation is efficient

Q48: Refer to Exhibit 8-9.Show that fixed costs

Q54: The target inflation rate for many central

Q55: According to the economic fluctuations model,what would

Q78: A production function relates output to its

Q90: The addition to total variable cost when

Q100: Draw an aggregate demand inflation adjustment diagram

Q112: The initial response of real GDP to

Q120: Suppose that at the target inflation rate