Capital budgeting computations

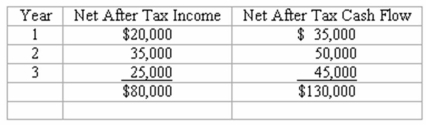

A project costing $80,000 has an estimated life of 3 years and no salvage value.The estimated net income and net after tax cash flows from the project are as follows:  The company's minimum desired rate of return for discounted cash flow analysis is 10%.The present value of $1 at compound interest of 10% at 1,2,and 3 years is 0.909,0.826,and 0.751 respectively.The present value of a $1 annuity for three years at 10% is 2.487.The company uses straight-line depreciation.

The company's minimum desired rate of return for discounted cash flow analysis is 10%.The present value of $1 at compound interest of 10% at 1,2,and 3 years is 0.909,0.826,and 0.751 respectively.The present value of a $1 annuity for three years at 10% is 2.487.The company uses straight-line depreciation.

Compute

(a)Net present value of the project _________________________.

(b)The rate of return on average investment __________________.(rounded)

Calculations

Definitions:

Insecure Attachment

A type of attachment style where individuals show anxiety or avoidance in relationships, often due to adverse experiences in early development.

Artificial Mothers

In psychological studies, inanimate objects that provide comfort or security to infant animals, simulating maternal presence.

Basic Trust

A fundamental sense of confidence in the reliability and predictability of the world, often established in early childhood.

Co-Parenting Fathers

Fathers who actively share parenting responsibilities with their partners or ex-partners, focusing on the well-being and upbringing of their children.

Q12: Aircraft Products,a manufacturer of aircraft landing gear,makes

Q20: Budgeted debt service costs<br>On April 1,Fisher Corporation

Q23: When the size of the market increases,the

Q31: A stock option is a right to

Q40: Relevant costs in business decisions<br>(a)Explain what is

Q52: Nanu Corporation manufactures two products; data are

Q64: Cost-volume relationships<br>(a)What is the effect of an

Q77: Exchange market devaluation or revaluation has been

Q86: A depreciation of a country's currency means<br>A)it

Q136: All else the same,a country with population