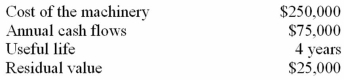

Redman Company is considering an investment in new machinery.The details of the investment are as follows:  The company uses straight-line depreciation for its machinery and requires a 12% rate of return.The present value of $1 for 4 years at 12% is 0.636.The present value of an ordinary annuity for $1 for 4 years at 12% is 3.037.

The company uses straight-line depreciation for its machinery and requires a 12% rate of return.The present value of $1 for 4 years at 12% is 0.636.The present value of an ordinary annuity for $1 for 4 years at 12% is 3.037.

(1)What is the payback period? (Round your answer to one decimal place.)

(2)What is the rate of return on average investment? (Round your percentage to one decimal place.)

(3)What is the net present value?

(4)Would you advise the company to invest in this machinery?

Definitions:

Cash Budget

A financial plan that estimates cash inflows and outflows over a specific period, often used to assess whether a company will have sufficient cash to meet its obligations.

Cash Receipts

The collection of money, typically currency or checks, received by a business during its operating activities.

Cash Payments

Transactions that involve the outflow of cash to settle obligations or purchase items.

Ski Jackets

A type of outerwear designed for protecting the body from cold temperatures and snow, especially during skiing.

Q11: Operating earnings rather than net income is

Q15: The Lastrom Company provided the following information

Q15: If a business activity qualifies as a

Q21: The set of activities necessary to create

Q26: External auditors are often called upon to

Q76: Standard cost system-using variance data<br>During its first

Q84: According to the data in Exhibit 29-1,the

Q109: Refer to Exhibit 30-1.If the importing country

Q117: If the Multifiber Agreement had used tariffs

Q119: Which of the following is true?<br>A)Trade restrictions