Capital budgeting computations

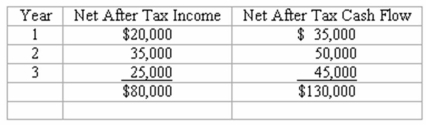

A project costing $80,000 has an estimated life of 3 years and no salvage value.The estimated net income and net after tax cash flows from the project are as follows:  The company's minimum desired rate of return for discounted cash flow analysis is 10%.The present value of $1 at compound interest of 10% at 1,2,and 3 years is 0.909,0.826,and 0.751 respectively.The present value of a $1 annuity for three years at 10% is 2.487.The company uses straight-line depreciation.

The company's minimum desired rate of return for discounted cash flow analysis is 10%.The present value of $1 at compound interest of 10% at 1,2,and 3 years is 0.909,0.826,and 0.751 respectively.The present value of a $1 annuity for three years at 10% is 2.487.The company uses straight-line depreciation.

Compute

(a)Net present value of the project _________________________.

(b)The rate of return on average investment __________________.(rounded)

Calculations

Definitions:

Automatic Processes

Cognitive functions that occur without conscious awareness or effort, often simultaneously with other tasks.

Subconscious Processes

Mental activities occurring without conscious awareness, influencing perceptions, thoughts, and behaviors.

Controlled Processes

Tasks that require active and conscious effort and attention, such as learning something new.

Consciousness

An individual’s awareness of external events and internal sensations under a condition of arousal, including awareness of the self and thoughts about one’s experiences.

Q3: In a flexible budget for a profit

Q25: The relevant costs and revenues to consider

Q33: Disneyland charges visitors for admission to the

Q111: The East Asian currency crisis of 1997

Q114: According to the data in Exhibit 29-1,which

Q142: Why is it necessary for individual property

Q165: Country A has a comparative advantage over

Q174: An international treaty and organization that until

Q176: The Smoot-Hawley tariff of 1930 had the

Q239: According to the data in Exhibit 29-1,the