Capital budgeting

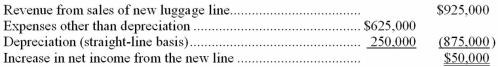

Carry-Along is debating whether or not to invest in new equipment to manufacture a line of high-quality luggage.The new equipment would cost $850,000,with an estimated four-year life and no salvage value.The estimated annual operating results with the new equipment are as follows:  All revenue from the new luggage line and all expenses (except depreciation)will be received or paid in cash in the same period as recognized for accounting purposes.You are to compute the following for the investment in the new equipment to produce the new luggage line: (rounded)

All revenue from the new luggage line and all expenses (except depreciation)will be received or paid in cash in the same period as recognized for accounting purposes.You are to compute the following for the investment in the new equipment to produce the new luggage line: (rounded)

(a)Annual cash flow: $__________

(b)Payback period: __________

(c)Return on average investment: __________%

(d)Total present value of the expected future annual cash flows,discounted at an annual rate of 12% (an annuity table shows that the present value of $1 received annually for four years discounted at 12% is 3.037): $__________

(e)Net present value of the proposed investment: $__________

Definitions:

Subsidy

Financial support extended by the government to an economic sector (or institution, business, or individual) with the aim of promoting economic and social policy.

Highly Elastic

Refers to a strong responsiveness of the quantity demanded or supplied of a good to a change in its price.

Statutorily Granted

Pertains to rights or powers given or enforced by a legislative body or statute.

Government Subsidy

Financial assistance provided by the government to individuals, organizations, or industries to support their operation or reduce the price of their products.

Q8: Which of the following is not one

Q13: Which of the following is one of

Q13: Costs that have not yet been incurred

Q23: A master budget is a comprehensive financial

Q23: Identify the criticisms of using ROI (Return

Q34: Non-financial factors are relevant in capital budgeting.

Q55: Using cost-volume-profit formulas<br>Fantasy Corporation manufactures a single

Q55: The Fine Point Company currently produces all

Q86: A depreciation of a country's currency means<br>A)it

Q225: Suppose that each firm in an industry