Responsibility income statement-cost classification

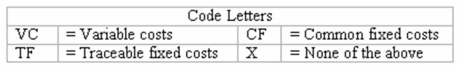

Milton's,a large department store,prepares income statements by sales department.These statements follow the contribution margin approach,showing contribution margin and responsibility margin for each profit center as well as monthly income from operations for the store.Indicate the classification of each of the costs listed below by inserting the appropriate code letters in the space provided.  Costs

Costs

____ (a)The cost of merchandise sold in the Women's Sportswear Department.

____ (b)Advertising a sale in the Housewares Department (classify as a fixed cost).

____ (c)Depreciation on equipment used in the Automotive Service Department.

____ (d)Depreciation on the store's heating and air conditioning system.

____ (e)Monthly salary of the manager of the Toy Department.

____ (f)Sales taxes collected from customers and paid to local tax authorities.

____ (g)Monthly salaries of store security guards.

Definitions:

Basket Purchase

The acquisition of a group of assets or products together in a single transaction, often at a bundled price.

Design Fees

Charges levied for the professional service of creating plans, drawings, or layouts for constructions, graphics, interiors, product designs, or other creative works.

Building Permits

Official approvals granted by local government authorities allowing the construction, renovation, or major alteration of a building.

Insurance During Construction

A policy covering risk of loss or damage to a construction project.

Q11: The following information is for the Choplin

Q15: The Lastrom Company provided the following information

Q25: If the standard quantity of materials is

Q27: A process costing system is highly desirable

Q27: The manufacturing efficiency ratio equals:<br>A)Value-added time divided

Q41: Identifying information relevant to a particular business

Q46: Even though costs,revenues,and other factors do not

Q86: A depreciation of a country's currency means<br>A)it

Q88: If the end of the fiscal year

Q103: Until the related goods are sold,product costs