Accounting Terminology Listed Below Are Eight Technical Accounting Terms Introduced or Emphasized

Accounting terminology

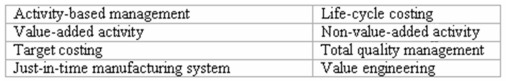

Listed below are eight technical accounting terms introduced or emphasized in this chapter:  Each of the following statements may (or may not)describe one of these technical terms.In the space provided below each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

Each of the following statements may (or may not)describe one of these technical terms.In the space provided below each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

_____ (a)The process of using activity-based costs to help reduce or eliminate non-value-added activities.

_____ (b)Can be eliminated without affecting the desirability of the product from the perspective of the customer.

_____ (c)The length of time for a product to pass completely through a specific manufacturing process.

_____ (d)If eliminated,the desirability of the product to consumers is decreased.

_____ (e)Consideration of all potential resources that will be consumed by a product from development through disposal.

_____ (f)A method in which a product's cost is determined by subtracting a fixed profit margin from its selling price.

_____ (g)An approach that explicitly monitors quality costs and rewards quality enhancing behavior.

Definitions:

Defecate

The natural process of expelling feces from the body's rectum and anus as part of the digestive system's waste elimination.

Loop Colostomy

A surgical procedure in which a loop of the large intestine is brought through the abdominal wall to create a stoma for waste to exit the body.

Stoma

A surgically created opening on the body’s surface to allow for the elimination of waste, commonly associated with procedures like colostomies.

Mucus

A thick, slippery substance produced by mucous membranes and glands to moisturize and protect certain parts of the body.

Q7: The Plaza Company has working capital of

Q8: Manufacturing overhead is considered an indirect cost,since

Q10: The year-end balance in the Materials Inventory

Q11: Responsibility accounting systems measures the performance of:<br>A)The

Q29: Depreciation expense reduces net income but does

Q35: Which of the following is not one

Q43: Cost-volume-profit analysis is often complex when applied

Q50: Which of the following is not a

Q55: An unfavorable labor rate variance could most

Q90: Income statement classifications<br>Simon Hardware and Garfunkel Foods