Process costing system-determining unit costs

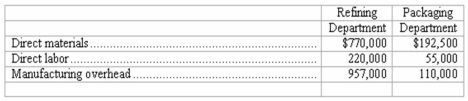

Houston Oil Company uses a process costing system with two departments: (a)a Refining Department and (b)a Packaging Department.During June,its first month of operations,the company manufactured and sold 650,000 gallons of motor oil,generating total revenue of $3,845,000.The company incurred the following manufacturing costs in June:  (a)How much was the unit cost per gallon of oil processed by the Refining Department in June?

(a)How much was the unit cost per gallon of oil processed by the Refining Department in June?

(b)If each case of oil contains four gallons,how much was the unit cost per case incurred by the Packaging Department in June?

(c)How much was the unit cost per case transferred to finished goods in June? (Round your final answer to one decimal place.)

(d)How much total gross profit was generated by the company in June? (Do not round intermediate calculations)

Definitions:

Weighted Average Inventory Valuation

A method for valuing inventory by calculating the average cost of all inventory items, weighted by the quantities of each item.

Perpetual Inventory System

An accounting method that records the sale or purchase of inventory immediately through the use of computerized point-of-sale systems and enterprise asset management software.

Sales Revenue

The total income received by a company from its sales of goods or services, before any expenses are subtracted.

FIFO

An inventory valuation method where goods first purchased or produced are the first to be sold, standing for First-In, First-Out.

Q9: Which of the following is not true

Q11: Royal Corporation uses the indirect method of

Q21: The gross profit rate is gross profit

Q40: When volume increases,fixed cost per unit:<br>A)Increases.<br>B)Decreases.<br>C)Stays the

Q53: In a production cost report,the units transferred

Q56: The transfer price is the dollar amount

Q67: The term responsibility center reflects the idea

Q68: The part of a business a particular

Q76: The type of cost accounting system best

Q90: Income statement classifications<br>Simon Hardware and Garfunkel Foods