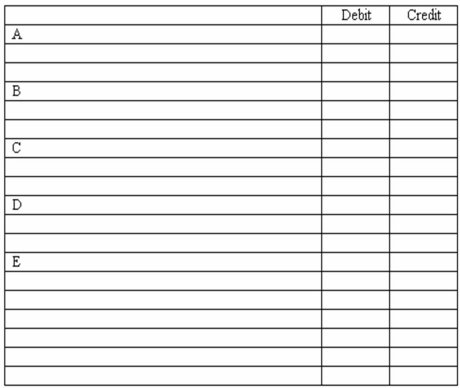

Job order cost system-journal entries

Paxton Products,which uses a job order cost system,completed the following transactions during the current month:

(A)Materials costing $75,000 were used on various jobs.

(B)Time cards of direct workers indicate direct labor costs of $125,000 for the month.

(C)Overhead is applied to jobs at a rate of 75% of direct labor cost.

(D)Jobs with total accumulated costs of $165,000 were finished during the month.

(E)Units costing $210,000 were sold during the month at sales prices totaling $390,000.All sales were on account.

In the space provided,prepare a general journal entry for the month summarizing each of the above categories of transactions.Explanations may be omitted.

Definitions:

Fixed Costs

Fixed costs are expenses that do not change with the level of production or sales, such as rent, salaries, and insurance premiums.

Variable Costs

Expenses that change in proportion with the level of business activity or production volume, such as raw materials and direct labor costs.

Target Income

The desired profit level that a company aims to achieve within a specific period, often used in budgeting and financial planning.

Contribution Margin

The amount of revenue remaining after subtracting variable costs, used to cover fixed costs and generate profit.

Q39: Overhead application rates allow overhead to be

Q44: A responsibility accounting system measures the performance

Q58: A product sells for $125,variable costs are

Q65: Licensing maintains control over product creation while

Q66: A budget that can be easily adjusted

Q72: When a company uses peak pricing,it is

Q81: Measures of solvency and credit risk<br>Shown below

Q84: What are the total manufacturing overhead costs

Q93: In a multiple-step income statement,income taxes are

Q94: The quality of earnings tends to be