Allocating activity cost pools to products

Laughton Corporation makes two styles of cases for compact disks,the standard case and the deluxe case.The company has assigned $210,000 in monthly manufacturing overhead to three cost pools as follows: $90,000 to machining costs,$60,000 to production set-up costs,and $60,000 to inspection costs.

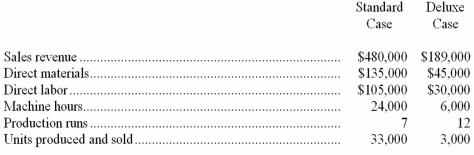

Additional monthly data are provided below:  The first and last unit in each production run is inspected for quality control purposes.Inspection costs are allocated to the products based on the number of inspections required.Machining costs are allocated to products using machine hours as an activity base.Set-up costs are allocated to products based on the number of production runs each product line requires.

The first and last unit in each production run is inspected for quality control purposes.Inspection costs are allocated to the products based on the number of inspections required.Machining costs are allocated to products using machine hours as an activity base.Set-up costs are allocated to products based on the number of production runs each product line requires.

(a)Allocate manufacturing overhead from the activity cost pools to each product line.

(b)Compare the total per-unit cost of manufacturing standard cases and deluxe cases.

(c)On a per-unit basis,which product appears to be more profitable?

Definitions:

Q7: Make-or-buy decision<br>Currier,Inc.,manufactures and distributes a large number

Q13: The interest coverage ratio is computed by

Q22: As foreign exchange rates fall,importers based in

Q39: A company with an operating income of

Q42: Determine the amount of manufacturing overhead given

Q53: Hines Cannery issued capital stock in 2015

Q56: Maple syrup and pancakes are examples of

Q72: Diluted earnings per share are shown to

Q79: Cash flows from operating activities-indirect method<br>In the

Q88: Contribution margin ratio is equal to contribution