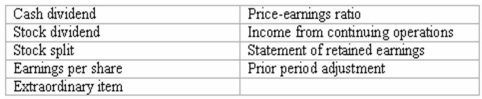

Accounting terminology

Listed below are nine technical accounting terms introduced in this chapter:  Each of the following statements may (or may not)describe one of these technical terms.In the space provided beside each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

Each of the following statements may (or may not)describe one of these technical terms.In the space provided beside each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

____ (a)A financial statement showing the revenue,expenses,and net earnings of a corporation during the current accounting period.

____ (b)A distribution of cash to stockholders.

____ (c)A distribution to stockholders of additional shares of stock,accompanied by a proportionate reduction in the par value per share.

____ (d)The market price of a share of p

Definitions:

Unit Product Cost

The total cost (variable and fixed) associated with producing one unit of a product.

Year 2

A fictional or unspecified second year in a sequence or period being referred to, often relative to a specific context or event.

Absorption Costing

A method of costing that takes into account all expenses of production, including direct materials and labor, and both kinds of manufacturing overheads, variable and fixed, in determining a product's cost.

Operating Income

Income generated from a company's primary business operations, excluding deductions of interest and taxes.

Q8: Format of a cash flows statement-direct method<br>Arrange

Q43: An asset which costs $18,800 and has

Q45: A stock split will decrease the par

Q54: The quick ratio is a more stringent

Q82: Which of the following best describes retained

Q84: A liability for deferred income taxes represents:<br>A)Income

Q101: Depreciation; gains and losses in financial statements<br>In

Q104: The book value of equipment:<br>A)Increases with the

Q108: Which of the following is not an

Q110: In a manufacturing company,the "just-in-time" concept of