Stock dividend-effect on book value

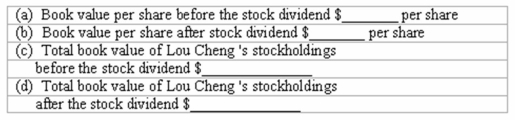

Olympic Corporation has 75,000 shares of $1 par value stock outstanding.The largest single stockholder is Lou Cheng,who owns 6,000 shares.On December 31,the total assets of the company amount to $4,360,000 and total liabilities to $2,230,000.On that date,the board of directors declared a stock dividend of one new share for each five shares outstanding.Compute the following:

Definitions:

Double Taxation

The imposition of two or more taxes on the same income, asset, or financial transaction, often seen in international business where income is taxed in both the source and the resident country.

Secured Bond

A bond backed by collateral to decrease the risk of default.

Due Process

A fundamental legal principle that ensures fair treatments and procedures are followed by the government before depriving a person of life, liberty, or property.

Fourth Amendment

A provision in the U.S. Constitution protecting individuals from unreasonable searches and seizures by the government.

Q7: For depreciable property other than real estate,MACRS

Q9: Which of the following is not true

Q9: If the terms of a sale are<br>F.O.B.shipping

Q20: For financial reporting purposes,the gain or loss

Q25: Any rational,systematic method of depreciation is acceptable,as

Q43: When goods are completed and transferred from

Q46: Explain the major provisions of the Foreign

Q70: In the year following an overstatement of

Q85: From a creditor's point of view,the lower

Q133: The half-year convention permits a company to