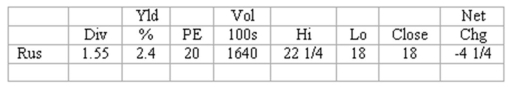

Stock values

Presented below is an excerpt from the stock listings of a recent issue of the Wall Street Journal.  Answer the following questions based on the information about the Russell Corporation given above:

Answer the following questions based on the information about the Russell Corporation given above:

(a)How many shares of Russell Corporation stock were sold on this day?

(b)If you had purchased 10 shares of Russell Corporation stock at the lowest price of the day,what would be the total price that you would have paid for the stock?

(c)What was the closing price of Russell Corporation Stock on the previous day?

(d)If the board of directors of Russell Corporation increased the amount of the annual dividends to $1.00 per share,what would be the amount of the yield percentage on the stock?

Definitions:

Carrying Value

The net amount at which an asset or liability is reported on the balance sheet, calculated as original cost minus any depreciation, amortization, or impairment costs.

Common Stock

A type of security that represents ownership in a corporation, with holders having a claim on the company's earnings and assets.

Income Tax Rate

The percentage at which an individual or corporation is taxed on their income.

Straight-Line Method

A method of calculating depreciation of an asset, which assumes the asset will lose an equal amount of value each year over its useful life.

Q38: Empire Company uses the indirect method to

Q40: The sale of treasury stock at a

Q41: The directors of a corporation:<br>A)Are hired by

Q43: Computation of profitability ratios<br>Shown below are selected

Q62: Mayer Instrumentation sold a depreciable asset for

Q63: Which of the following is not classified

Q68: Sum-of-the-years' digits is a popular depreciation method

Q75: There is a tax advantage for a

Q77: A store that sells expensive custom-made jewelry

Q97: Under the half-year convention,six months' depreciation is