Fully amortizing installment note payable

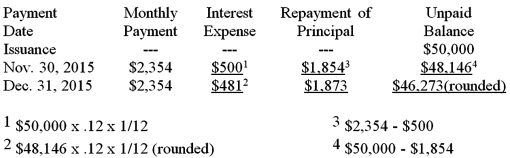

On October 31,2015 Ronald signed a 2-year installment note in the amount of $50,000 in conjunction with the purchase of equipment.This note is payable in equal monthly installments of $2,354,which include interest computed at an annual rate of 12%.The first monthly payment is made on November 30,2015.This note is fully amortizing over 24 months.

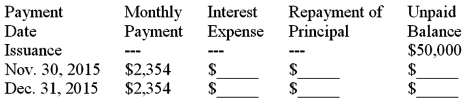

Complete the amortization table for the first two payments by entering the correct dollar amounts in the blank spaces provided.In addition,answer the questions that follow.  (a)With respect to this note,Ronald's 2015 income statement includes interest expense of $_______________,and Ronald's balance sheet at December 31,2015,includes a total liability for this note payable of ______________.(Do not separate into current and long-term portions.)

(a)With respect to this note,Ronald's 2015 income statement includes interest expense of $_______________,and Ronald's balance sheet at December 31,2015,includes a total liability for this note payable of ______________.(Do not separate into current and long-term portions.)

(b)The aggregate monthly cash payments Ronald will make over the 2-year life of the note payable amount to $_______________.

(c)Over the 2-year life of the note,the amount Ronald will pay for interest amounts to $_______________.

Definitions:

Signposts

cues or markers within a speech or writing that guide the audience through the structure and important points.

Classification

A method of arranging entities in an organized system based on common characteristics or themes.

Partition

The act of dividing something into parts or sections.

Organizational Patterns

The arrangement of ideas, concepts, or information in a structured manner within a text or presentation to enhance understanding and retention.

Q9: Which of the following would not be

Q64: Harvard Company purchased equipment having an invoice

Q82: When a corporation presents both "basic" and

Q95: A factor that might suggest that a

Q101: Supervox Corporation declared a 3-for-2 common stock

Q115: The purpose of developing the subtotals "Income

Q116: The financial statements of Baxter Corporation include

Q119: In preparing the bank reconciliation,certain transactions recorded

Q121: Large cash flows from operations are more

Q125: A company had 125,000 shares of common