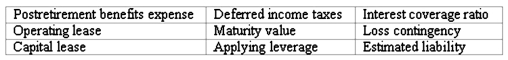

Accounting terminology

Listed below are nine technical accounting terms introduced in this chapter:  Each of the following statements may (or may not)describe one of these technical terms.In the space provided beside each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

Each of the following statements may (or may not)describe one of these technical terms.In the space provided beside each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

_____ (a)Operating income divided by annual interest expense.

_____ (b)The amount paid during the current period to retired employees.

_____ (c)A lease agreement that is viewed as equivalent to the lessee purchasing the leased asset.

_____ (d)Using borrowed money to finance business operations.

_____ (e)The risk of a loss occurring in a future period.

_____ (f)A permanent reduction in the amount of income taxes owed which results from the tax deductions for depreciation.

_____ (g)The amount that must be paid to settle a liability at the date it becomes due.

Definitions:

Compound Interest

Interest calculated on the initial principal, which also includes all of the accumulated interest from previous periods.

Exponential Decay

A decrease in quantity that occurs at a rate proportional to the current total, often seen in contexts like radioactive decay.

Arithmetic Operations

Core math processes involving plus, minus, times, and divided by.

Percentage Calculation

The process of determining the portion or fraction of a whole that is represented by a specific number, often used in financial and statistical analyses.

Q6: Sutton Supplies reports net sales of $3,750,000,net

Q56: Fully amortizing installment notes<br>When Sue Meadow purchased

Q75: In a periodic inventory system,a complete physical

Q88: The amortization of a bond premium:<br>A)Decreases the

Q89: Charging an expenditure directly to an expense

Q96: Choose the statement that correctly summarizes the

Q103: When an Allowance for Doubtful Accounts is

Q122: Estimating the useful life and residual value

Q151: All the following are steps included in

Q168: Notes receivable-computations<br>Complete the following statements about promissory