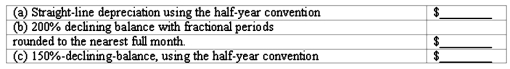

Various depreciation methods-first year

On March 24,2015 Tastee Ice Cream Co.purchased equipment costing $140,000,with an estimated life of 5 years and an estimated salvage value of $20,000.

Compute the depreciation expense Tastee would recognize on this equipment in 2015,assuming:

Definitions:

Cost Of Living Adjustment

An increase in income or wages to counteract inflation, aimed at maintaining an individual's standard of living.

Education

The systematic process of facilitating learning, or the acquisition of knowledge, skills, values, beliefs, and habits through various means such as teaching, training, storytelling, discussion, and directed research.

Economic Recession

A temporary slump in economic activities, with reduced trade and industry output, often determined by a continuous fall in GDP over two quarters.

Permanent Income

A theory suggesting individuals base their consumption patterns on their long-term average income rather than their current income.

Q32: A prior period adjustment to retained earnings

Q38: In computing earnings per share,the number of

Q47: After all the closing entries have been

Q60: The income statement,statement of retained earnings,and the

Q60: Gross profit rates a practical application<br>Note to

Q69: Which of the following has no effect

Q70: In the year following an overstatement of

Q81: Retained earnings<br>At the beginning of 2015,Falcon Corporation

Q98: If an accelerated depreciation method is used

Q133: Bert had accounts receivable of $280,000 and