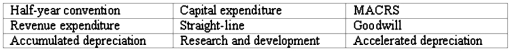

Accounting terminology

Listed below are nine technical accounting terms introduced in this chapter:  Each of the following statements may (or may not)describe one of these technical terms.In the space provided below each statement,indicate the accounting term described,or Answer "None" if the statement does not correctly describe any of the terms.

Each of the following statements may (or may not)describe one of these technical terms.In the space provided below each statement,indicate the accounting term described,or Answer "None" if the statement does not correctly describe any of the terms.

_____ (a.)An expenditure to pay an expense of the current period.

_____ (b.)The accelerated depreciation system used in federal income tax returns for depreciable assets purchased after 1986.

_____ (c.)A policy that fractional-period depreciation on assets acquired or sold during the period should be computed to the nearest month.

_____ (d.)An intangible asset representing the present value of future earnings in excess of normal return on net identifiable assets.

_____ (e.)Expenditures that could lead to the introduction of new products,but which,according to the FASB,should be viewed as an expense of the current accounting period.

_____ (f.)Depreciation methods that take less depreciation in the early years of an asset's useful life,and more depreciation in the later years.

_____ (g.)An account showing the portion of the cost of a plant asset that has been written off to date as depreciation expense.

Definitions:

Bone Scan

A diagnostic imaging test that uses a small amount of radioactive material to detect abnormalities or changes in the bones.

CT Scan

A medical imaging procedure that combines multiple X-ray measurements to create detailed cross-sectional images of the body.

X-ray

A type of radiation used in medical imaging to view internal structures of the body.

Congenital Hip Dysplasia

A birth defect where the hip joint has not formed properly, which may lead to dislocation or problems with walking.

Q21: During a period of steadily falling prices,which

Q35: Which of the following would be classified

Q47: Which of the following should not be

Q62: The pension expense of the current period

Q63: In a periodic inventory system,when a sale

Q63: When a promissory note is issued,you would

Q90: When the LIFO costing method is in

Q105: Gross profit is the difference between:<br>A)Net sales

Q105: When a company sells bonds between interest

Q107: Financial assets--effects of transactions<br>Five events involving financial