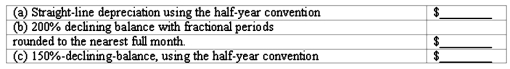

Various depreciation methods-first year

On March 24,2015 Tastee Ice Cream Co.purchased equipment costing $140,000,with an estimated life of 5 years and an estimated salvage value of $20,000.

Compute the depreciation expense Tastee would recognize on this equipment in 2015,assuming:

Definitions:

Individualist

A person who defines herself or himself in terms of personal traits and gives priority to her or his own goals.

Rejecting-neglecting

A type of parenting lacking in both responsiveness and demandingness, often leading to negative outcomes for children.

Permissive-indulgent

A parenting style characterized by high responsiveness but low demands, leading to children who may struggle with self-discipline and control.

Warmth/responsiveness

A parenting style characterized by being emotionally supportive and responsive to children's needs, important for fostering secure attachments and psychological well-being.

Q15: During the closing process:<br>A)All income statement accounts

Q28: Taylor,Inc.had accounts receivable of $310,000 and an

Q44: In a perpetual inventory system,two entries are

Q45: One of the major steps in achieving

Q49: An advantage of the average-cost method of

Q71: To arrive at net sales:<br>A)Add sales discounts

Q78: A bank reconciliation explains the differences between:<br>A)Cash

Q97: Under the half-year convention,six months' depreciation is

Q126: Once the estimated life is determined for

Q140: The future value will always be less