Inventory flow assumptions

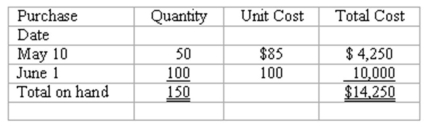

The perpetual inventory records of Handy Hardware show 150 units of a particular product on hand,acquired at the following dates and costs:  On June 3,Handy sold 120 units of this product.

On June 3,Handy sold 120 units of this product.

Instructions: Prepare a journal entry to record the cost of goods sold relating to the sale on June 3,assuming that Handy uses: (Show your computations as per below format.)

(a)A LIFO flow assumption.

(b)A FIFO flow assumption.

(c)The average cost (or moving average)flow assumption.

Definitions:

Controllable Variance

Controllable variance is a measure used in managerial accounting to assess the differences between actual and budgeted amounts that management can influence or control.

Variable Overhead Costs

Variable overhead costs fluctuate with changes in production volume, including costs like utilities and raw materials not directly tied to a product.

Fixed Overhead Costs

Expenses that remain constant irrespective of the volume of production or sales, including rent, salaries, and insurance.

Production Volume

The total quantity of goods or services produced by a company during a specific period.

Q9: Factors affecting the market price of stocks<br>(a)Murdock

Q34: Publicly owned companies are:<br>A)Managed and owned by

Q61: In a perpetual inventory system,an inventory cost

Q64: Only two adjustments appear in the adjustments

Q73: Regardless of the number of special journals

Q83: A worksheet consists of all of the

Q98: An unrealized holding gain on available for

Q107: VanRoy Supplies reports net sales of $1,750,000,net

Q120: Which of the following will cause net

Q130: Working capital is equal to current assets