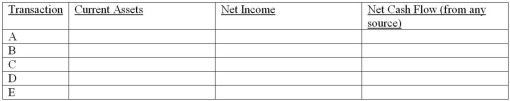

Financial assets-effects of transactions

Five events involving financial assets are described below:

(a.)Sold merchandise on account.

(b.)Sold available for sale marketable securities at a gain.Cash proceeds from the sale were equal to the current market value of the securities reflected in the last balance sheet.

(c.)Collected an account receivable.

(d.)Adjusted the allowance for doubtful accounts to reflect the portion of accounts receivable estimated to be uncollectible at year-end.

(e.)Made the fair value accounting adjustment reducing the balance in the available for sale marketable securities account to reflect a decrease in the market value of securities owned.

Indicate the effects of each independent transaction or adjusting entry upon the financial measurements shown in the column headings below.Use the code letters,I for increase,D for decrease,and NE for no effect.

Definitions:

Manufacturing Cost

The total expense involved in the production of goods, including materials, labor, and overhead costs.

Normal Standards

Predetermined benchmarks or criteria that are set to measure efficiency or performance levels in various business operations.

Production Difficulties

Challenges or obstacles encountered during the process of manufacturing or producing goods.

Direct Labor Standard

A predefined measure of the amount of labor time that is considered necessary to produce one unit of output.

Q10: Bank reconciliation-classification<br>Indicate how the following items would

Q30: At year-end,all equity accounts must be closed.

Q36: The matching principle is best demonstrated by:<br>A)Using

Q44: Jayson Products uses a perpetual inventory system.At

Q46: Which of the following activities affects net

Q51: Adjustments and closing process--basic entries<br>Selected ledger accounts

Q54: Assets are considered current assets if they

Q66: To capitalize an expenditure means charging it

Q67: Interest that has accrued during the accounting

Q92: The primary reason a physical inventory is