End-of-period adjustments - selected computations

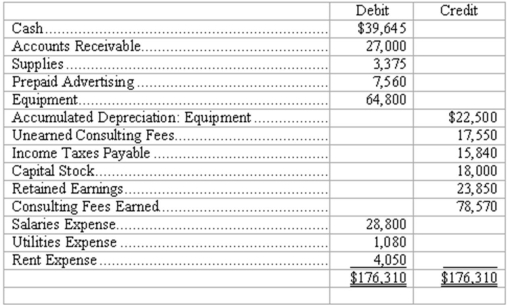

Allied Architects adjusts its books each month and closes its books at the end of the year.The trial balance at January 31,2015,before adjustments is as follows:  The following information relates to month-end adjustments:

The following information relates to month-end adjustments:

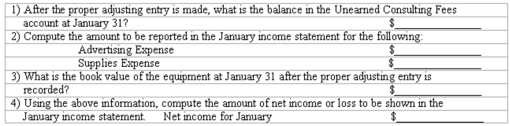

(a)According to contracts,consulting fees received in advance that were earned in January total $13,500.

(b)On November 1,2015,the company paid in advance for 5 months' advertising in professional journals.

(c)At January 31,supplies on hand amount to $2,250.

(d)The equipment has an original estimated useful life of 4 years.

(e)The corporation is subject to income taxes of 25% of taxable income.(Assume taxable income is the same as "income before taxes.")

Definitions:

Productivity

The measure of the efficiency of production, often evaluated as the output per unit of input in a given time period.

Language

A system of communication using sounds or symbols that enables humans to express thoughts, emotions, ideas, and messages.

Recognize Patterns

The ability to identify recurring shapes, structures, or sequences in sets of information or data.

Concentrated Effort

A focused application of mental or physical energy towards a specific task or goal.

Q20: The value of sample information is the

Q28: The purchase of equipment on credit is

Q30: A future amount is the dollar amount

Q39: The accounting cycle begins with the<br>A)Posting of

Q55: A revenue transaction will result in all

Q82: The Financial Accounting Standards Board (FASB)maintains and

Q85: Accounting terminology<br>Listed below are nine accounting terms

Q86: In the notes to financial statements,adequate disclosure

Q91: Ledger accounts are updated through a process

Q115: Recording transactions journal entry grid<br>A list of