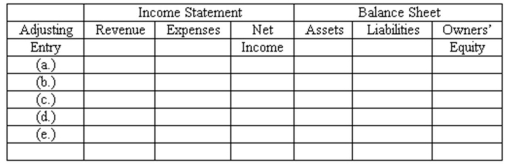

Adjusting entries-effect on elements of financial statements

Galaxy Entertainment prepares monthly financial statements.On July 31,the accountant made adjusting entries to record:

(A.)Depreciation for the month of July.

(B.)The portion of prepaid rent for outdoor stage and seating which had expired in July.

(C.)Earning of ticket revenue for July which had been subscribed in advance.(When patrons purchase the Summer Jazz Series tickets in advance,the accountant credits Unearned Ticket Revenue.)

(D.)Amount owed to Galaxy from the caterer who sold food and beverages during the July performances.The amount due will be paid to the company on August 8.

(E.)Amount owed to the musicians which had accrued since the last pay day in July.

Indicate the effect of each of these adjusting entries on the major elements of the company's financial statements-that is,on revenue,expenses,net income,assets,liabilities,and owners' equity.Organize your answer in tabular form,using the column headings shown below and the symbols + for increase,- for decrease,and NE for no effect.

Definitions:

Receptor Cells

Specialized cells that detect and respond to physical or chemical stimuli, converting them into electrical signals.

Cones

Photoreceptor cells in the retina of the eye responsible for color vision and functioning best in bright light.

Fovea

A small depression in the retina of the eye where visual acuity is highest due to the concentration of cones.

Peripheral Vision

The part of vision that occurs outside the very center of gaze, allowing for the detection of stimuli through the sides of the eyes.

Q14: Unearned revenue appears:<br>A)As income on the income

Q16: Paddle,Inc.purchased equipment for $14,760 on February 1,2015.The

Q22: Thirty percent of the total assets of

Q31: Recording transactions directly in T accounts; trial

Q86: A business that is profitable and liquid

Q88: The terms "sales discount" "purchase discount" and

Q101: Clinton prepares monthly financial statements.Which of the

Q102: Subsidiary ledgers<br>Listed below are several merchandising transactions

Q113: The American Institute of Certified Public Accountants

Q164: Financial assets:<br>A)Consist of cash and cash equivalents.<br>B)Are