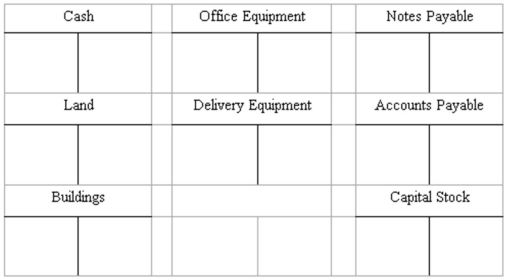

Recording transactions directly in T accounts; trial balance

On July 20,Mollie Rose began a new business called MR Printing,which provides typing,duplicating,and printing services.The following six transactions were completed by the business during July.

(A.)Issued to Rose 1,000 shares of capital stock in exchange for her investment of $200,000 cash.

(B.)Purchased land and a small building for $450,000,paying $165,000 cash and signing a note payable for the balance.The land was considered to be worth $240,000 and the building $210,000.

(C.)Purchased office equipment for $30,000 from Quality Interiors,Inc.Paid $17,000 cash and agreed to pay the balance within 60 days.

(D.)Purchased a motorcycle on credit for $3,400 to be used for making deliveries to customers.Mollie agreed to make payment to Spokes,Inc.within 10 days.

(E.)Paid in full the account payable to Spokes,Inc.

(F.)Borrowed $30,000 from a bank and signed a note payable due in six months.

Instructions

(A.)Record the above transactions directly in the T accounts below.Identify each entry in a T account with the letter shown for the transaction.This exercise does not call for the use of a journal.  (B.)Prepare a trial balance at July 31 by completing the form provided.

(B.)Prepare a trial balance at July 31 by completing the form provided.

Definitions:

Primary Market Transactions

The issuance and sale of securities directly from the issuer to investors, as opposed to trading between investors in the secondary market.

Dutch Auctions

A type of auction where the auctioneer starts with a high asking price which is lowered until some participant accepts the price.

Public Offerings

The process by which a company sells its shares to the public for the first time through a stock exchange.

Partnership

A legal form of business operation between two or more individuals who share management and profits.

Q6: Sutton Supplies reports net sales of $3,750,000,net

Q8: The Income Summary account has debits of

Q30: A c chart used for statistical quality

Q41: The New York Stock Exchange and the

Q60: The income statement,statement of retained earnings,and the

Q60: When a company uses the double-entry method,the

Q74: In its simplest form an account has

Q106: Cost of goods sold is an expense

Q120: Earning revenue increases owners' equity and expenses

Q126: Internal control over cash transactions<br>Listed below are