Recording transactions in T accounts; trial balance

On May 15,George Manny began a new business,called Sounds,Inc.,a recording studio to be rented out to artists on an hourly or daily basis.The following six transactions were completed by the business during May:

(A.)Issued to Manny 5,000 shares of capital stock in exchange for his investment of $200,000 cash.

(B.)Purchased land and a building for $410,000,paying $100,000 cash and signing a note payable for the balance.The land was considered to be worth $310,000 and the building $100,000.

(C.)Installed special insulation and soundproofing throughout most of the building at a cost of $120,000.Paid $32,000 cash and agreed to pay the balance in 60 days.Manny considers these items to be additional costs of the building.

(D.)Purchased office furnishings costing $18,000 and recording equipment costing $88,400 from Music Supplies.Sounds paid $28,000 cash with the balance due in 30 days.

(E.)Borrowed $180,000 from a bank by signing a note payable.

(F.)Paid the full amount of the liability to Music Supplies arising from the purchases in D above.

Instructions

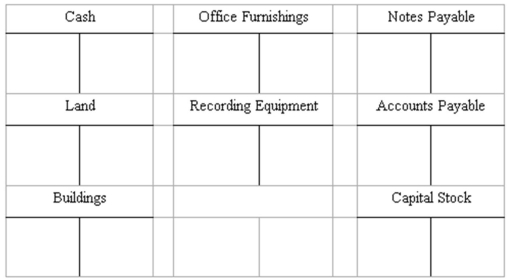

(A.)Record the above transactions directly in the T accounts below.Identify each entry in a T account with the letter shown for the transaction.This exercise does not call for the use of a journal.  (B.)Prepare a trial balance at May 31 by completing the form provided.

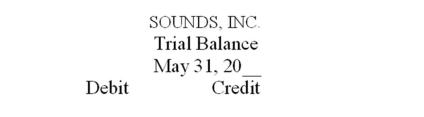

(B.)Prepare a trial balance at May 31 by completing the form provided.

Definitions:

Q2: Accounting equation<br>(A.)During the current year,the assets of

Q9: Note receivable--journal entries<br>On September 1,2015,Dental Equipment Corporation

Q35: The purpose of the after-closing trial balance

Q48: The operating cycle of a merchandiser is

Q54: Generally accepted accounting principles:<br>A)Are based on official

Q58: In comparison with a financial statement prepared

Q75: In a decision-making under uncertainty scenario,the decision

Q83: Which of the following appears in the

Q86: At the beginning of 2015,Wilson Stores has

Q106: Master Equipment has a $17,400 liability to