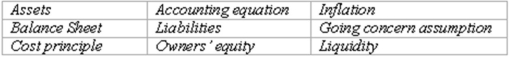

Accounting terminology

Listed below are nine technical accounting terms introduced in this chapter:  Each of the following statements may (or may not)describe one of these technical terms.In the space provided below each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.Do not use a term more than once.

Each of the following statements may (or may not)describe one of these technical terms.In the space provided below each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.Do not use a term more than once.

(A.)Having the financial ability to pay debts as they become due.

(B.)An assumption that a business will operate in the foreseeable future.

(C.)Economic resources owned by businesses that are expected to benefit future operations.

(D.)The debts or obligations of a business organization.

(E.)Assets = Liabilities + Owners' Equity

(F.)The principle which states that assets are valued in the balance sheet at their historical cost.

(G.)A residual amount equal to assets minus liabilities.

Definitions:

Consumer Surplus

Consumer surplus is the difference between the total amount consumers are willing and able to pay for a good or service and the total amount they actually pay.

Tax Revenues

The income received by the government from taxes imposed on individuals and businesses, used to fund government activities and public services.

Deadweight Loss

A decrease in economic efficiency arising when a good or service fails to attain or cannot possibly attain equilibrium.

Deadweight Losses

Economic inefficiencies that occur when equilibrium in a market is not achieved or when market allocation of resources is not optimal, often due to externalities or government intervention.

Q8: Effects of a series of transactions on

Q11: Indicate which of the following accounts will

Q27: An interest rate of 12% a year

Q31: Ray Crofford is evaluating investment alternatives to

Q35: The salaries paid to partners are shown

Q50: A complete set of financial statements for

Q59: The tailoring of an accounting report to

Q59: Publicly owned companies must file their audited

Q91: The basic purpose of generally accepted accounting

Q96: The purpose of adjusting entries is to:<br>A)Prepare