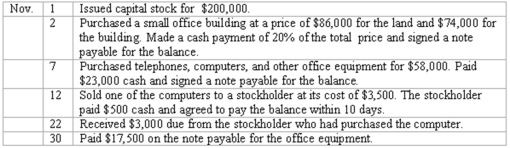

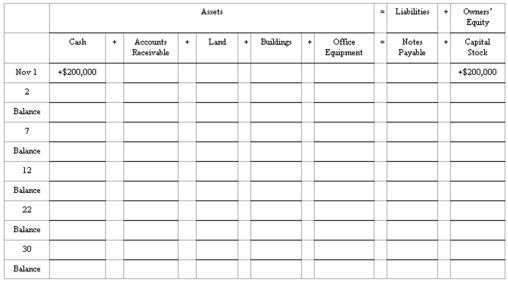

Effects of transactions on balance sheet items

Show the effect of each of the six listed transactions on the balance sheet items of Renaissance Investment Services,Inc.Indicate the new balances after the transaction of November 2 and each subsequent transaction.The effects of the November 1 transaction are already filled in to provide you with an example.

Definitions:

Operating Income

Income generated from a company's regular business operations, excluding expenses such as taxes and interest charges.

Variable Costs

Expenses that vary directly with the level of production or sales, such as materials and labor.

Break-even Sales

The amount of revenue required to cover total fixed and variable costs, resulting in zero profit or loss.

Fixed Costs

Expenses that do not change in proportion to the activity of a business, such as rent, salaries, and insurance premiums, remaining constant regardless of variations in business activity.

Q20: The HYPERLINK "http://www.statisticssolutions.com/mann-whitney-u-test" Mann-Whitney U-test requires that

Q22: Double Taxation means:<br>A)A corporation must pay double

Q22: Thirty percent of the total assets of

Q39: The accounts and their amounts for Belgrave

Q46: If Income Summary has a net credit

Q51: The sampling distribution of R,the number of

Q54: Assets are considered current assets if they

Q70: Contingency tables should not be used with

Q93: Which financial statement is prepared as of

Q114: Recording transactions in general journal<br>Enter the following