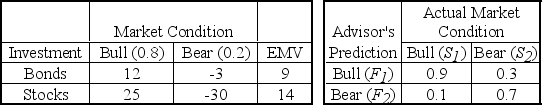

Ray Crofford is evaluating investment alternatives for the $100,000 which he inherited from his grandfather.His investment advisor has identified two alternatives and constructed the following tables which show (1) expected profits (in $10,000's) for various market conditions and their probabilities,and (2) the advisor's track record on predicting Bull and Bear markets.  If the advisor predicts a Bear market the EMV of the Bonds alternative,using revised probabilities,is ________.

If the advisor predicts a Bear market the EMV of the Bonds alternative,using revised probabilities,is ________.

Definitions:

Units of Output

The quantity of goods or services produced by a business, factory, or individual within a certain timeframe.

Value

Value refers to the importance, worth, or usefulness of something, often determined by its desirability, utility, or monetary worth.

Marginal Product of Labor

The additional output a firm produces as a result of hiring one more worker.

Profit-Maximizing

Profit-maximizing refers to strategies or actions taken by businesses to increase their profits to the highest possible level given their resources and market conditions.

Q3: The following ANOVA table is from a

Q14: Upper and lower control limits are usually

Q14: The forecast value for September 21.1

Q27: The F value that is used to

Q28: Explain what is meant by the "time

Q30: The process of constructing a mathematical model

Q37: How much must I invest today in

Q39: C,D,and E are partners.C has $25,000 in

Q61: A multiple regression analysis produced the following

Q103: When a business borrows money from a