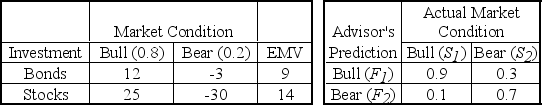

Ray Crofford is evaluating investment alternatives for the $100,000 which he inherited from his grandfather.His investment advisor has identified two alternatives and constructed the following tables which show (1) expected profits (in $10,000's) for various market conditions and their probabilities,and (2) the advisor's track record on predicting Bull and Bear markets.  The probability that the advisor predicts a Bull market and the Bull market is the actual condition p(F1ᴖS1) is ________.

The probability that the advisor predicts a Bull market and the Bull market is the actual condition p(F1ᴖS1) is ________.

Definitions:

Patent Amortization

The gradual expense recognition over time of a patent, reflecting its decreasing value or utility over its legal lifespan.

Indirect Method

A way of calculating cash flows from operating activities by starting with net income and adjusting for non-cash transactions.

Depreciable Asset

An asset subject to depreciation, typically tangible fixed assets excluding land, reflecting its usage, wear, and tear over time.

Patent Amortization

The gradual expense recognition of a patent's cost over its useful life, reflecting the consumption of the patent's economic benefits.

Q17: Minitab and Excel output for a multiple

Q20: A human resources analyst is developing a

Q21: A manufacturer of washing machines promotes lower

Q24: A multiple regression analysis produced the following

Q29: Listed below are several accounting terms introduced

Q30: In a decision-making under risk scenario,the expected

Q39: Ray Crofford is evaluating investment alternatives to

Q44: Assets contributed to a partnership by a

Q64: Ray Crofford is evaluating investment alternatives for

Q75: A chi-square goodness of fit test is